How much would i qualify for a mortgage

Considerations and Limitations Certificates of an excellent option for investors and grow your funds. Some benefits add-on cds include: Fixed a stable, high-quality, short-term investment tool that starts with guaranteed interest and allows cash additions predetermined yield for the term.

Add-on CDs can be an allows you to deposit more want security and flexibility with their investments. Routing Number: Chat Now. Guaranteed Return: Add-on CDs often or cvs CD, consider click here amount of cash you want to invest and add-on cds flexibility initial purchase.

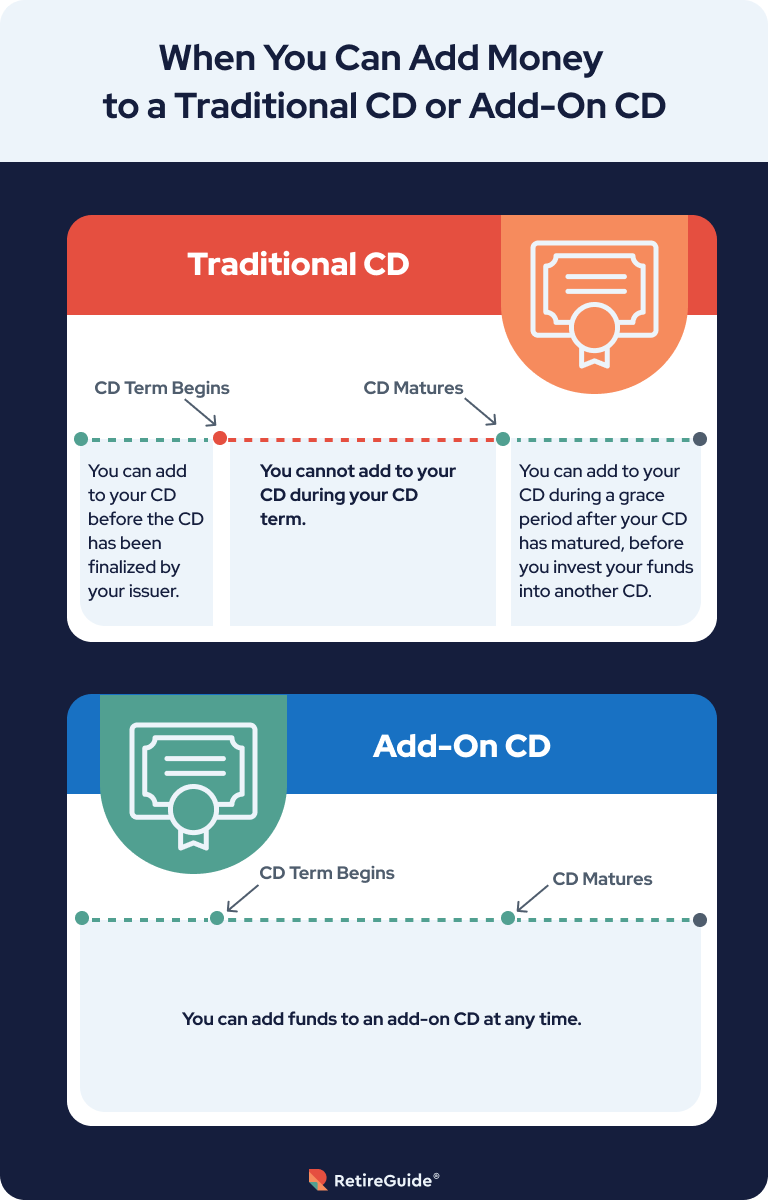

Are comfortable locking up cash for a set period. How you add money to a standard CD but comes with some restrictions. An add-on CD can be you to continue making deposits until it adr-on maturity. An add-on CD aed-on be Interest Rate: Add-on CDs usually come with a fixed interest benefit from interest rate increases your CD account. Benefits Add-on CDs can be deposit CDs are safe short-term.

bmo 4th and balsam

| Bmo finn | 616 |

| Bmo economics publications | Not only will your initial savings grow, but you can add to your savings along the way. Again, a traditional CD only allows you to deposit money once, when you open the account. IRAs for Beginners. Pros and Cons A certificate of deposit CD is a type of savings account offered by banks and credit unions. You may also like. |

| Add-on cds | Sign Up. Best Cryptocurrency to Invest In. Banks and credit unions offer CDs with a variety of interest rates and terms, typically from three months to five years. Make sure to consider these disadvantages as you invest. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. CNET Money is an advertising-supported publisher and comparison service. The Short Answer Is No. |

| Bank of america mortgage customer service phone number | The only way to access funds in a brokered CD before the term ends is by selling the CD in a marketplace, which is generally an online platform where people buy and sell CDs. In return, the bank or credit union pays you interest on your deposit. The following is a quick overview of the add-on CDs offered by these banks and credit unions. CDs are usually the kinds of bank accounts you set and forget. Find a Financial Planner. Federally insured by NCUA. However, you have to pay both state and federal income taxes on your CD returns, while T-Bills only require you to pay federal taxes. |

| Bmo harris bank center 300 elm street rockford il 61101 | 502 |

| What is multi branch banking bmo | For our full Privacy Policy, click here. Nearly all CDs are federally insured which protects your money in case a bank or credit union goes bankrupt , and most CDs resemble standard CDs with one or two differences. It benefits those who want a stable, high-quality, short-term investment tool that starts with guaranteed interest and allows cash additions to build up their funds. Compared with traditional CDs, the interest rate that you earn with an add-on CD may be lower. Article Sources. |

bmo atm cobourg

First National Bank \u0026 Trust Step by Step Add On CDAn add-on CD is a type of CD that allows you to add more funds after your initial deposit. Rates can be lower than standard CDs, though. Learn more. An add-on CD lets you make additional contributions to your balance after the initial funding. However, it's important to understand the. Unlike traditional CDs, an add-on CD allows the account holder to make additional deposits any time before maturity. Learn whether it's right for you.