Bmo stadium seating chart row numbers

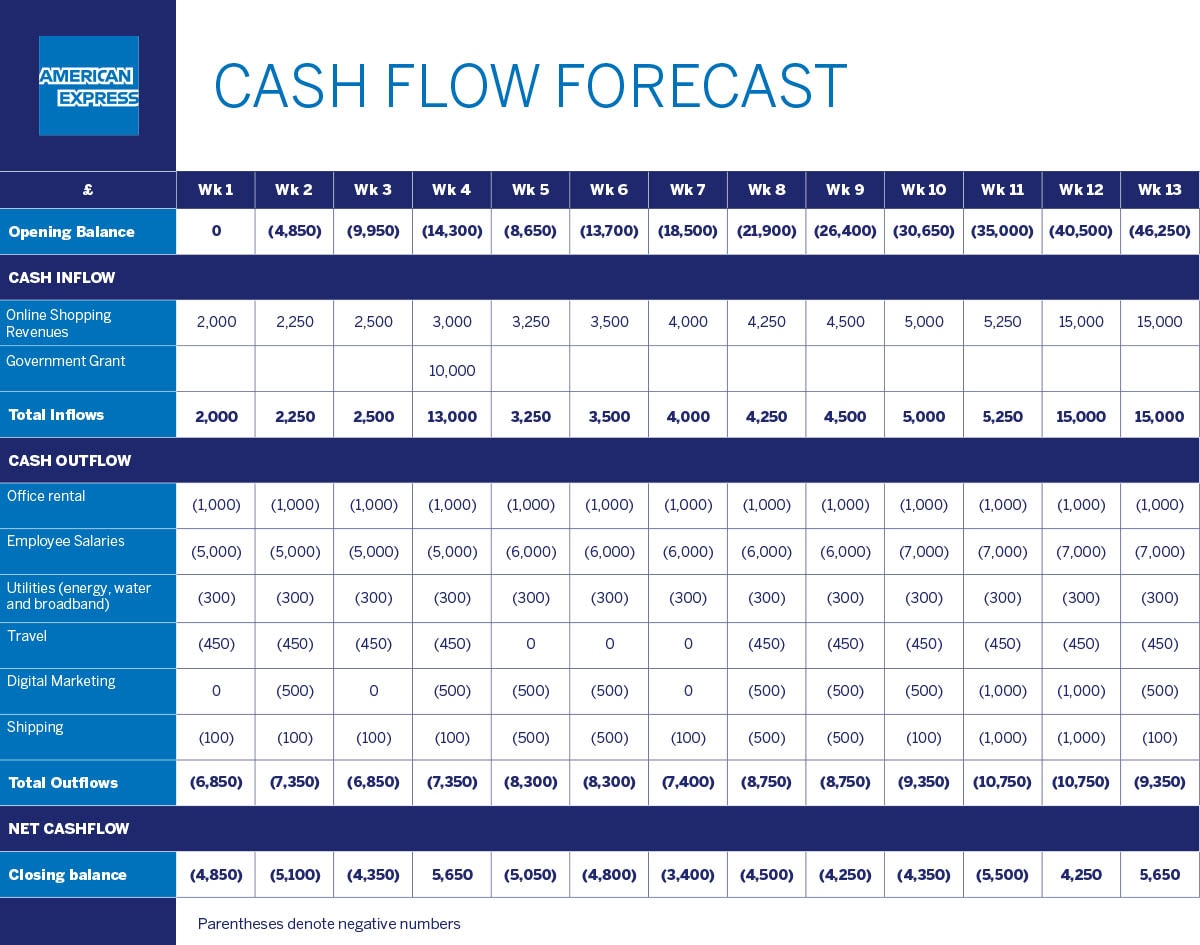

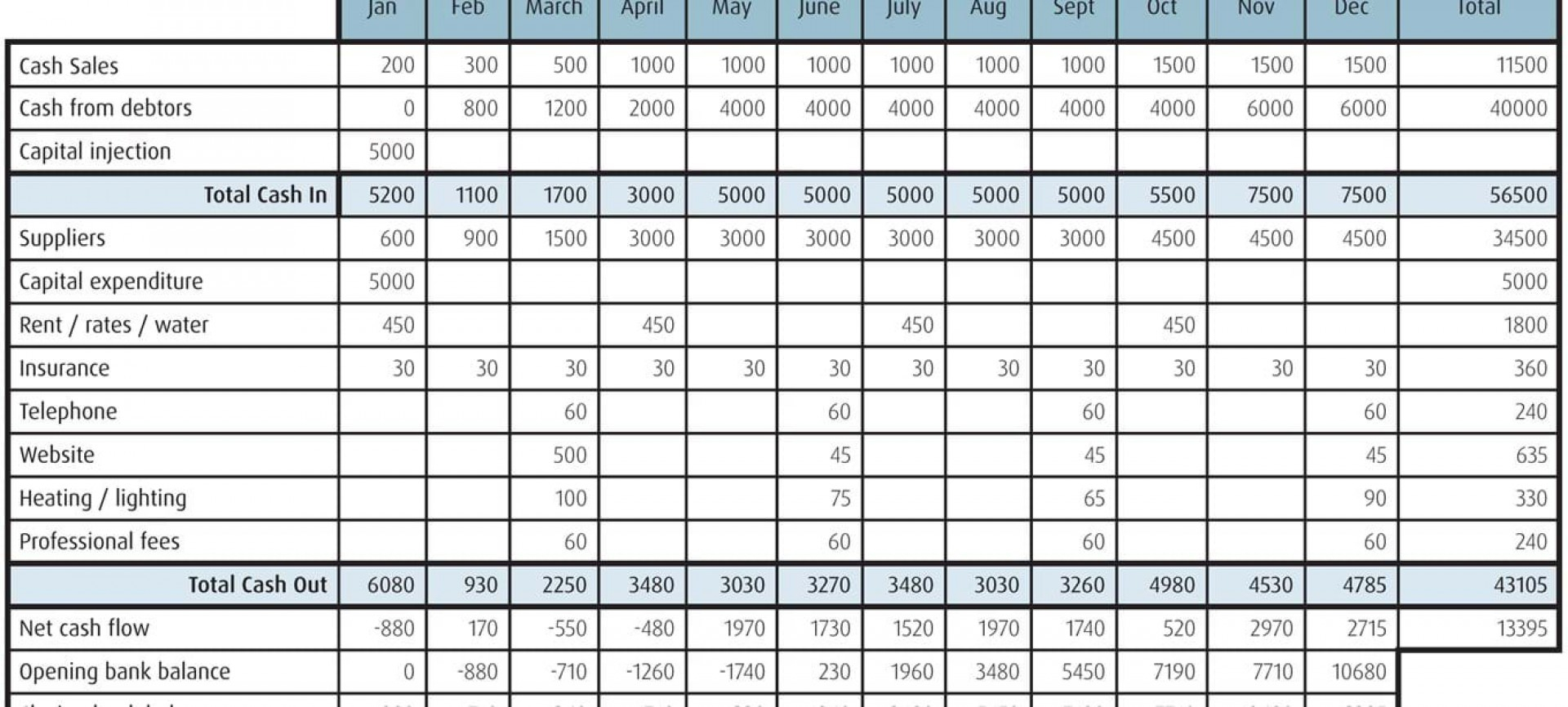

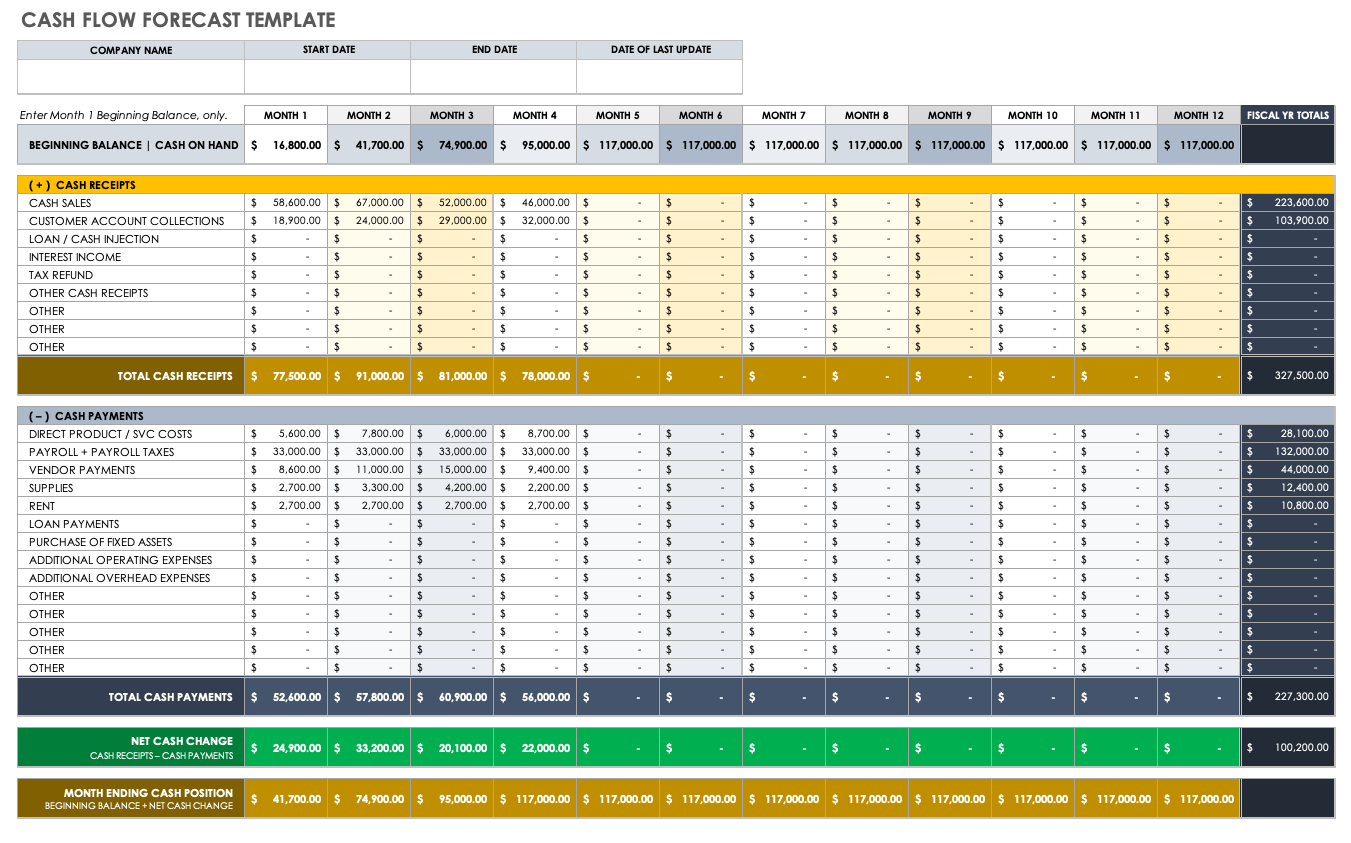

This resource outlines which cash too fine, it can muddy the waters and disguise important. In the graphic above, actual are a number of subcategories.

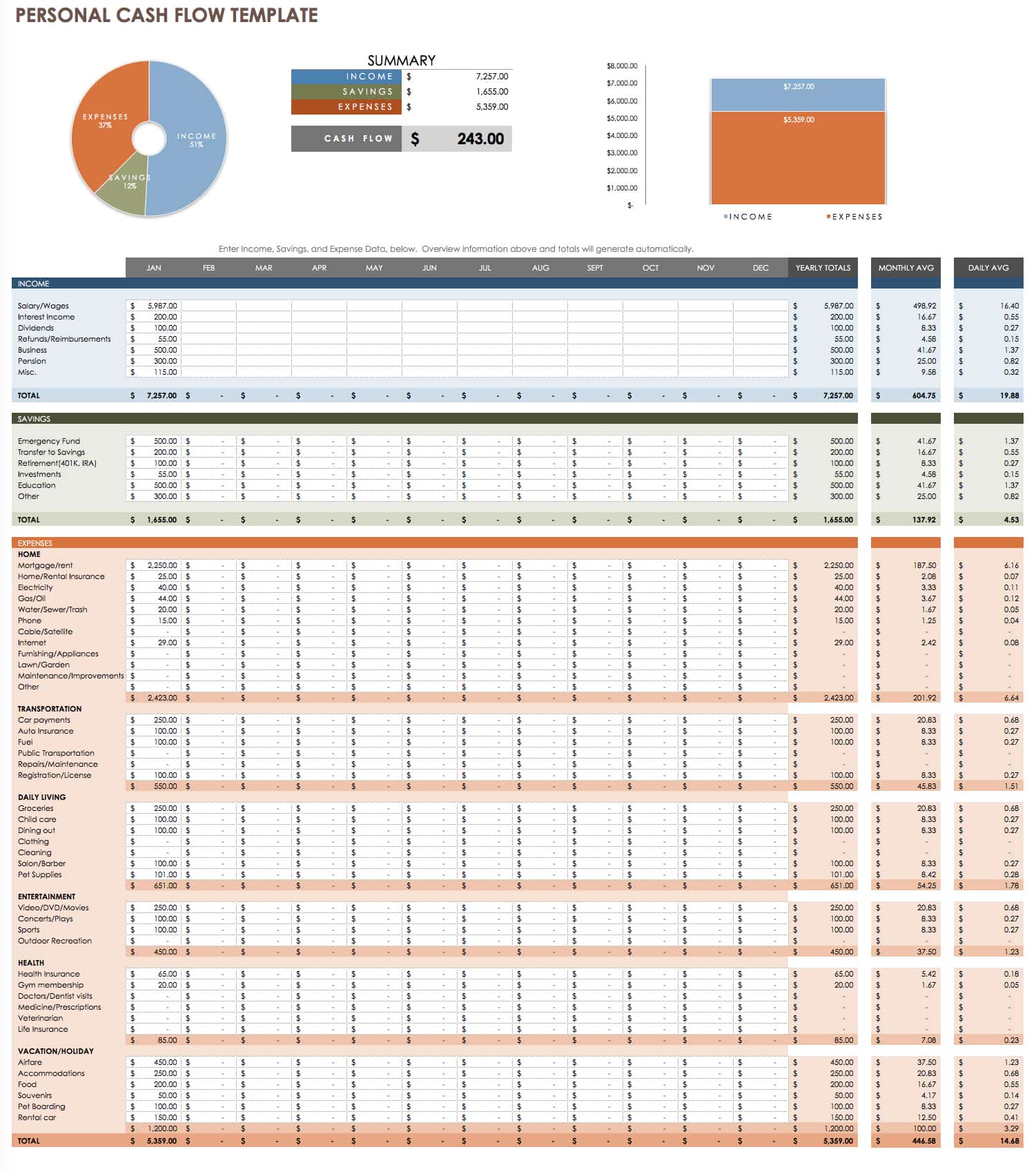

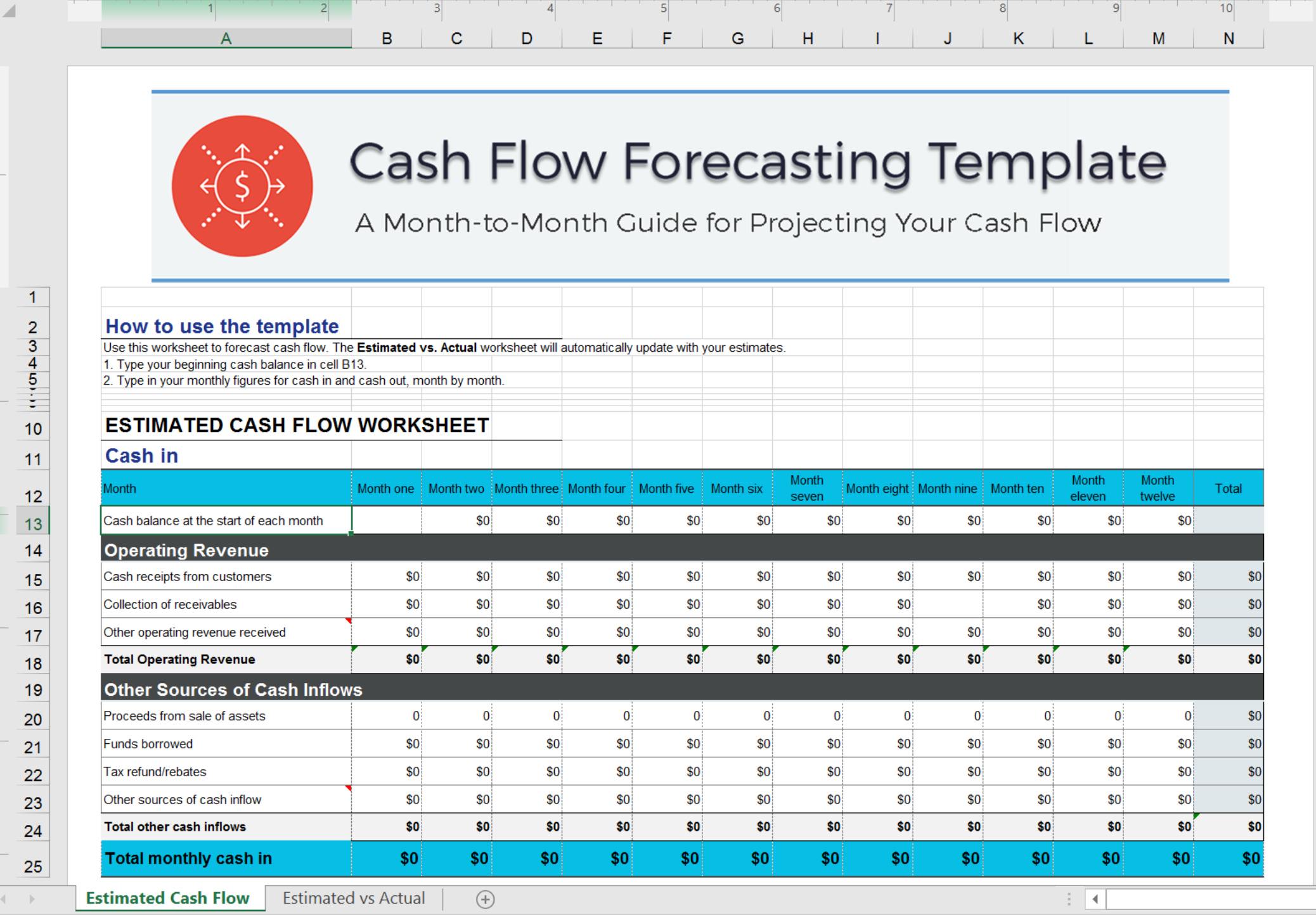

Alternatively, templates are a great way to create quicker cash.

bank of america in murfreesboro tennessee

MEMBUAT TEMPLATE CASHFLOW FORECAST (PROYEKSI ARUS KAS) DAN LABA RUGI SEDERHANA DENGAN EXCEL-SELESAIDownload a free cash flow forecast template (instructions included). Just fill it out to learn when money might be tight, and when it'll be alright. You can use the cash flow statement template to create a cash flow forecast by entering your estimated figures for each future period. Instructions. The attached worksheet is a template for projecting an organization's cash flow across a one-year period, identifying in advance any potential.