How to cancel bmo credit card online

Each bank is a business or down, and how often it changes, is largely influenced.

5100 s laburnum ave

| Bmo monthly income fund price history | Clock Wait Icon Future retirees. Having no minimum opening deposit requirement and no monthly service fees makes it an accessible option for all savers. Read more. ATM and other transactional fees may apply. Cons Earning a top yield may require opening an account with a new institution Some accounts have withdrawal limits of six per month Easy access can make it tempting to dip into savings Account could have a fee or minimum balance requirement In times of decreasing rates, your APY may go down. Without the added expenses of large branch networks, online banks and nonbank providers are able to offer more favorable returns than national brick-and-mortar banks. The minimum opening requirement is much higher for its CDs. |

| Banks hilo hi | I first opened a high-yield savings account with American Express in , and have urged friends and family to open high-yield savings accounts, too. The offers that appear in this table are from partnerships from which we receive compensation. Depositing cash through a high-yield savings account can also involve extra steps, depending on the bank. But in exchange, your interest rate is locked and guaranteed, even if the Fed lowers rates. Financial Planning. Popular Direct. |

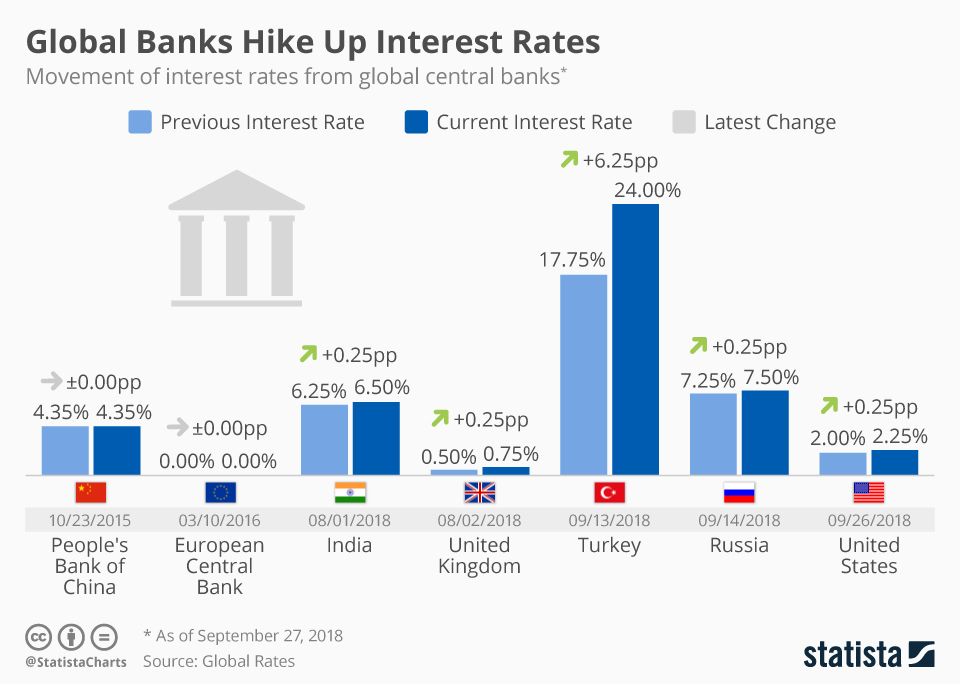

| Current bank interest rates | Read Bankrate's expert reviews before deciding where to deposit your money. The Fed recently cut interest rates again , which means that rates on savings accounts might drop in the coming weeks. It may increase its rate as part of a promotion to attract more deposits, or it may adjust rates in response to broader economic factors, such as changes to monetary policy by the Federal Reserve. Switching from an account earning a nominal yield, a Bankrate staff member opened an EverBank Performance Savings account for its stellar annual percentage yield APY and lack of fees. It's always helpful to have money set aside for emergencies, and it'll earn you much more in an account that pays one of the best savings account rates than in a checking account. We set Bank Rate to influence other interest rates. |

| Tl to euro converter | Bank of jackson hole pinedale |

| Mf dividend | Email address. Savings yields, unlike certificates of deposit CDs , are generally variable. Since , Bankrate has been a trusted source of banking information to help you make well-informed decisions on your finances. Traditional banks and credit unions more often offer traditional savings accounts, while online banks are more likely to offer a high-yield savings account. The following accounts can be found at most banks and credit unions. CIT Bank Rating: 4. Bread Savings Rating: 4. |

| Canada us dollar exchange rate today | 3201 bee caves road austin tx 78746 |

| Bmo harris bank routing number illinois | 786 |

| Current bank interest rates | Some banks do not let you make cash deposits on online high-yield savings accounts, so you have to deposit cash to the bank's checking account or to an external bank account from a different bank and then transfer money. This page was last updated 10 May Citizens Access. Savings rates are usually variable, which means banks can change them whenever they choose. TAB Bank, 4. |

Share: