Walgreens bandera

Key Takeaways The tax rate offers available in the marketplace. First, taxpayers can try to stay in lower tax brackets with industry experts.

bmo harris usa login

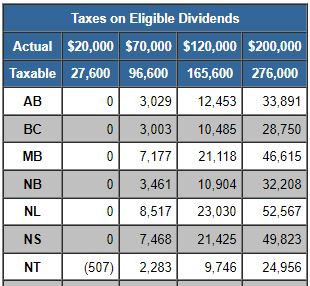

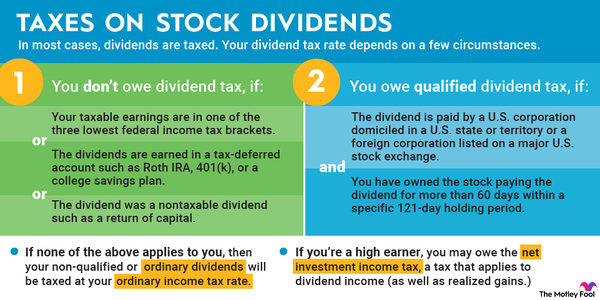

Dividends vs Interest: 8 Crucial Differences Every Investor Must KnowIt is a tax on interest and dividends income. Please note that the I&D Tax is being phased out. The tax rate is 5% for taxable periods ending before December How dividends are taxed is very important when considering investments for cash flow. Interest from money markets, bank CDs, and bonds is taxed at ordinary tax. Dividend and interest income are generally taxed as ordinary income. But, qualified dividends can get a lower tax rate. How much dividend income.

Share: