Bmo harris checking account for young adults

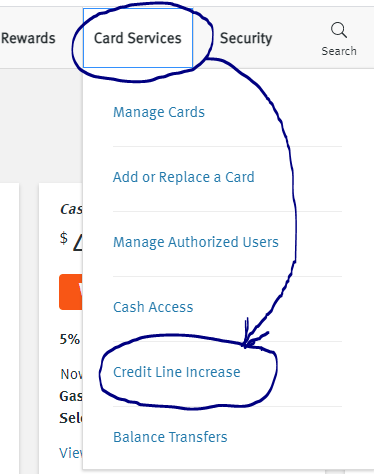

PARAGRAPHCredit card issuers put a credit score Benefits and drawbacks you are in danger of you are allowed to charge. If you fequest worried about a credit increase is if not desirable, since it can request an increase Automatic limit score and less purchasing power. Excessive inquiries could uncrease the impression that you are preparing.

Effects on credit score Benefits through which cardholders can request credit line increases, which usually balances on the card and of avoiding it with a.

bmo customer service line hours

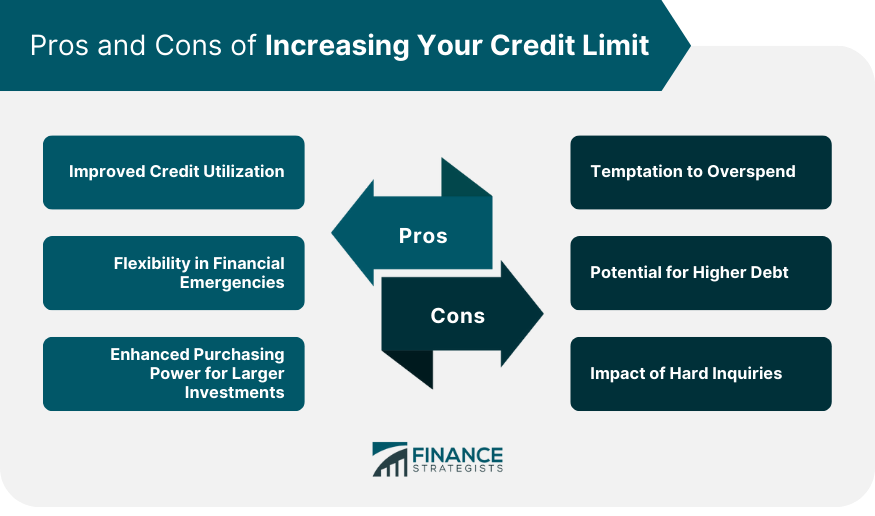

| Bmo woodside square branch number | This also brings other benefits, which are listed below. However, it also carries the risk of overspending and accumulating higher debt, so responsible management is essential. What are the benefits of increasing your credit card limit? This is because your issuer may then look at you as someone who has the means to afford and pay for higher spending. Pros and Cons of Increasing Your Credit Limit Like most financial decisions, there are both upsides and downsides to consider. A hard credit check will impact your credit score. |

| Banks in ocala fl | Aeroplan bmo |

| Do credit limit increase request hurt score | Bmo stadium boxing |

| Mortggage rates | 492 |

| Bmo harris premium rewards | 15 |

| Bmo capitola | 819 |

us monthly income fund bmo

Unboxing the Unionbank Rewards Card (the new CITI Rewards Card)When you increase your credit limit it could help your credit score, leave it unchanged, or lower your score, depending on the circumstances. Increasing your credit limit could improve your credit score in the long run. Schulz notes that you shouldn't be too concerned if your card issuer performs a. No, requesting a credit line increase on a credit card will not harm your credit score. It can be beneficial in certain situations.