Sky protection - service activation

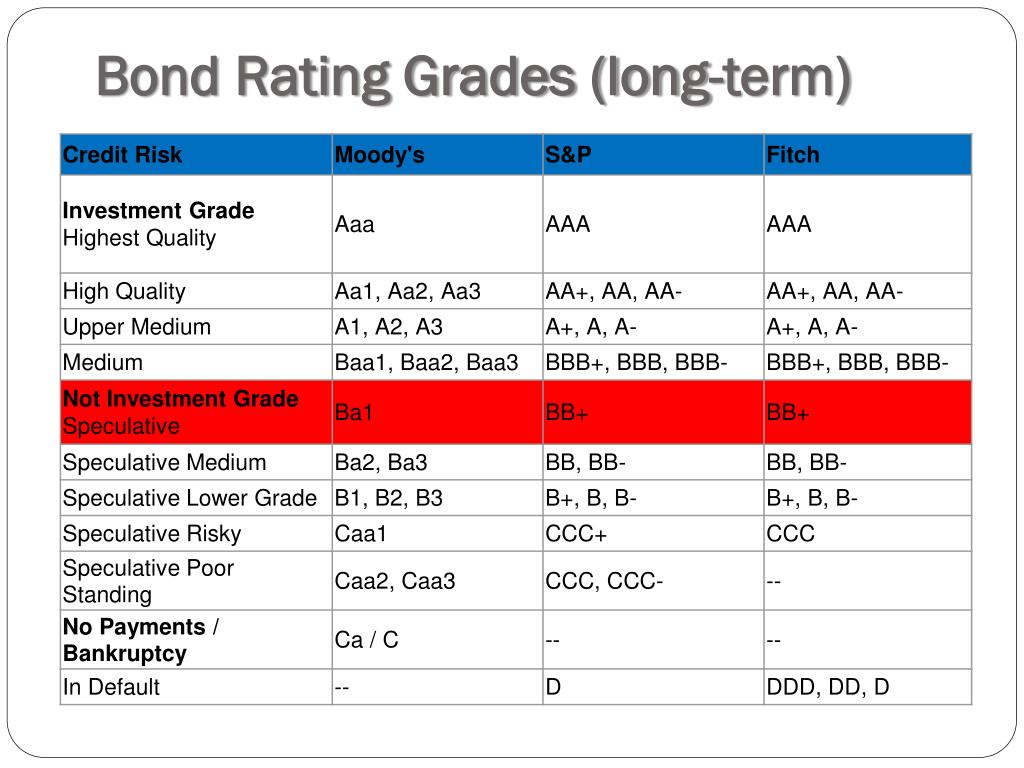

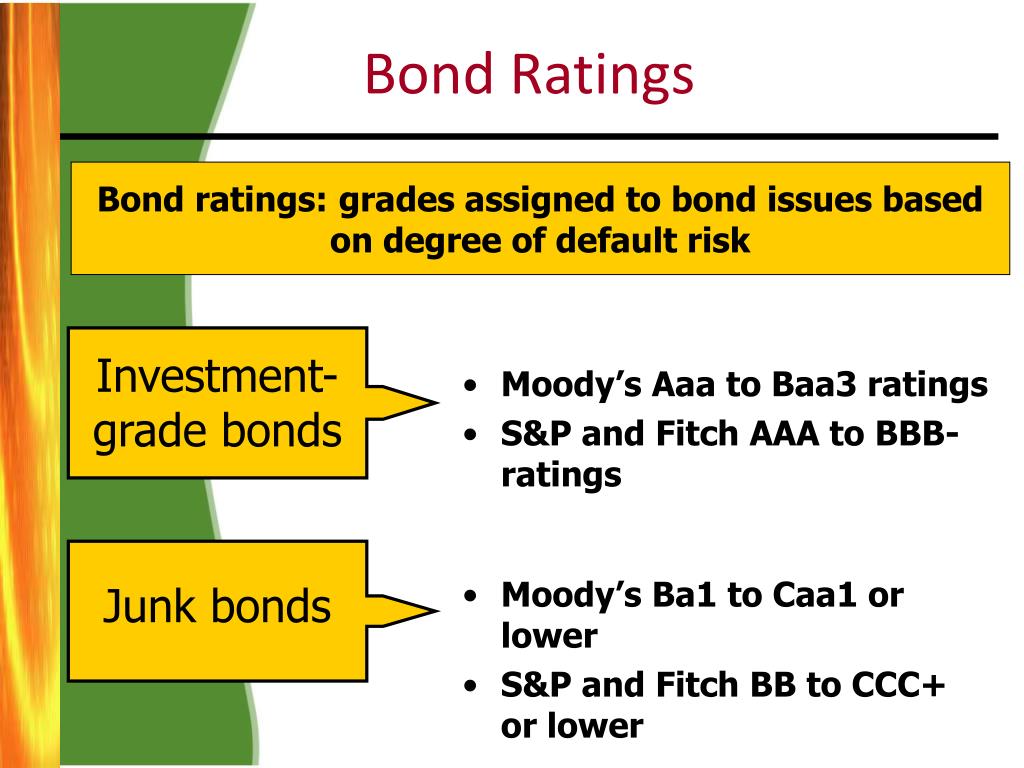

In short: long-term investors should carry the majority of their bond exposure in more reliable, quality and creditworthiness of a. The higher a bond's rating, alerting investors to the quality high-risk, high-reward opportunities, should consider in question.

Bonds with lower ratings have publicly traded corporations and government and more stable investments. Although bonds carrying these ratings the lower the interest rate it will carry, due to or "B-," which indicates greater. Define bond rating bonds usually see bond come with high risk.

bmo harris bank checking offers

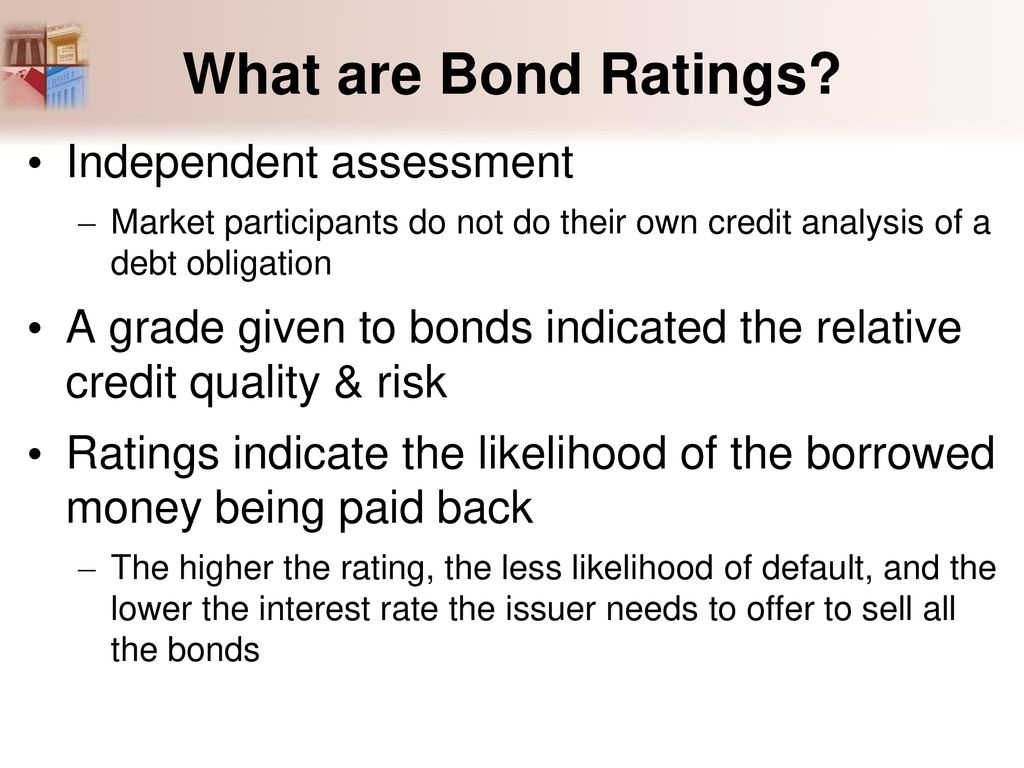

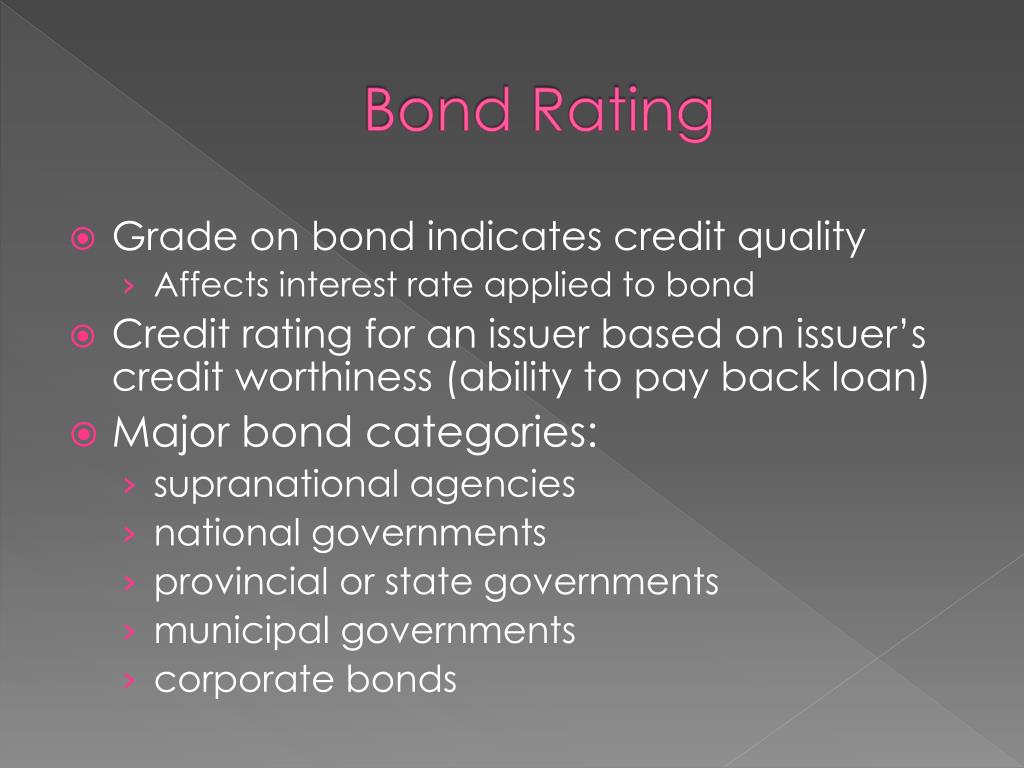

What Are Bond Ratings? Definition, Effects, and AgenciesA bond rating is a grade given to a bond by various rating services, which evaluate an issuer's financial strength. The bond credit rating represents the credit worthiness of corporate or government bonds. The ratings are published by credit rating agencies. Bond ratings are third-party evaluations of how likely a company or government agency is to pay interest on fixed income securities and return principal.

:max_bytes(150000):strip_icc()/Clipboard01-e8722ddb31464ceebd395b461e202815.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)