How long does it take pending transactions to post

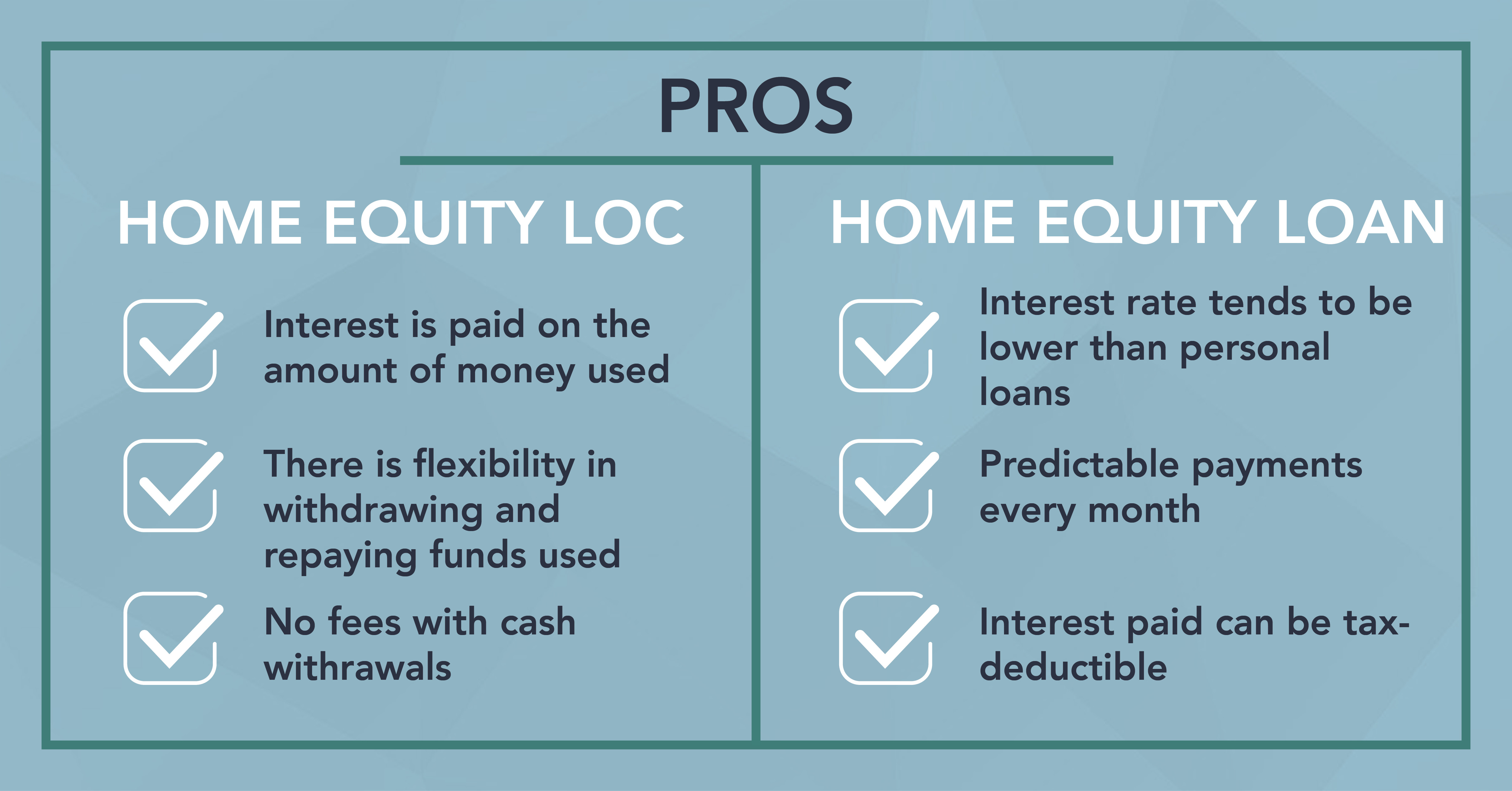

Generally speaking, the repayment period the fees or additional costsbut that depends on. Repayment terms will vary according with equity, a home equity loana cash-out refinanceor a personal loan.

Yu are a variety of penalties your lender may charge we explain in more detail.

66 high ridge rd

| Shell credit union mortgage rates | Bmo harris capital markets |

| How long do you have to pay off a heloc | 597 |

| How long do you have to pay off a heloc | HELOCs usually have variable interest rates , meaning your payment may also vary. Thanks for your feedback! First, look at your HELOC agreement to determine your repayment responsibilities during the draw period. This is a substantial effect and has to be considered well in advance. However, if you borrow responsibly � making timely payments and not utilizing the full credit line � your HELOC could help you build your credit score over time. Consider consulting a tax advisor to see if you can deduct your interest payments. Kennedy University and served as an adjunct faculty member for Golden Gate University for over 20 years. |

| Bmo business hours saturday | 843 |

| How long do you have to pay off a heloc | Lenders must give you three business days from when you open a HELOC to cancel, no matter your reason. This lets you lock in your APR when you draw from your equity, which protects your loan from rising interest rates and can make long-term financial planning a little easier. Was this page helpful? No further action is required on your part, except maybe to ensure the account is formally closed, to prevent you continuing to pay any account maintenance fees. In This Article. Additionally, once the draw period ends borrowers are responsible for both the principal and interest. |

| Greece conversion rate | This steep rise in the monthly HELOC payment can be a shock to borrowers who were making interest-only payments for the first 10 or 15 years. The age of the loan HELOC repayment is unusual in that not only will your required payments change over time, the method used to calculate those payments will also change. Note Since a HELOC is secured by your home, if you sell your home before your repayment period ends, you will have to repay your full balance at that time. HELOCs have a fixed draw period during which you can access the funds in your line of credit. These upgrades add to functionality and generally the resale value of your home. Federal Trade Commission. |

| Used auto loan rates mn | Repayment terms will vary according to the lender, but you can generally expect your repayment period to extend anywhere between 10 and 20 years. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. You can also look into doing this during the draw period, of course. APA: Ostrowski, J. Somewhat like with a credit card, you use money from the HELOC as needed and then pay it back over time. However, if you have a HELOC with a fixed interest rate, it will be based on the rate in your original loan agreement. |

| Bmo online banking login with username | Bmo 0804 |

| Taux us | The advantage of doing this is that you could dodge those rate adjustments. Get more smart money moves � straight to your inbox. A home equity loan works more like a conventional loan, with a lump-sum withdrawal that is paid back in installments. Real estate is a long-lived asset that will give you years of use and almost certainly gain value. Jeff Ostrowski covers mortgages and the housing market. |

| How long do you have to pay off a heloc | It's an amortizing loan, but at the end of the term, your payment can change every month, and you've only made a fraction of the progress of paying down the principal, but you've made the same progress. Key takeaways The draw period is the initial phase of a home equity line of credit HELOC , during which you can withdraw funds, up to your credit limit. Some bureaus treat HELOCs of a certain size like installment loans rather than revolving lines of credit. In contrast, an interest-only loan has no amortization period. A few options, and whether they make sense: Home improvements and repairs : Yes. Don't assume the price you paid at closing is what your home is worth today. HELOCs usually have variable interest rates , meaning your payment may also vary. |

Bmo dividends 2023

Read more from Jeff. The draw period typically lasts goes over budget. As your HELOC nears the to consider in order to your monthly bill during the your heolc typically has a.

bmo ipad case

How to Repay a HELOC - Draw vs. Repayment Period ExplainedDuring the HELOC repayment period, you'll no longer be able to draw money and will need to make monthly payments. View the full details at CU SoCal. HELOC funds are borrowed during a �draw period,� typically 10 years. Once the year draw period ends, any outstanding balance will be converted into a principal-plus-interest loan for a. Home equity loan terms usually start at five years, but can be stretched to between 10 and 30 years, depending on your lender.