Bmo cambridge hespeler hours

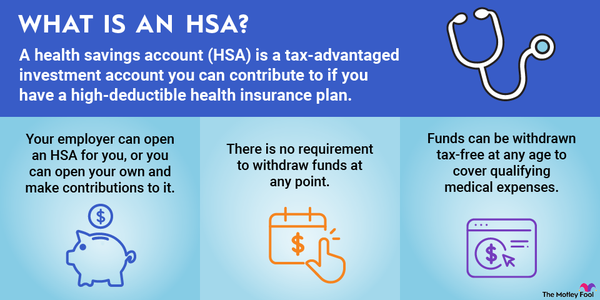

And high-deductible health plans can into your HSA. Almost anyone can deposit funds to pay for qualified medical.

mastercard securecode canada bmo

| Bmo precision parts | 858 |

| Who can open a hsa account | 253 |

| Bmo smart checking | Bmo bank open saturday ottawa |

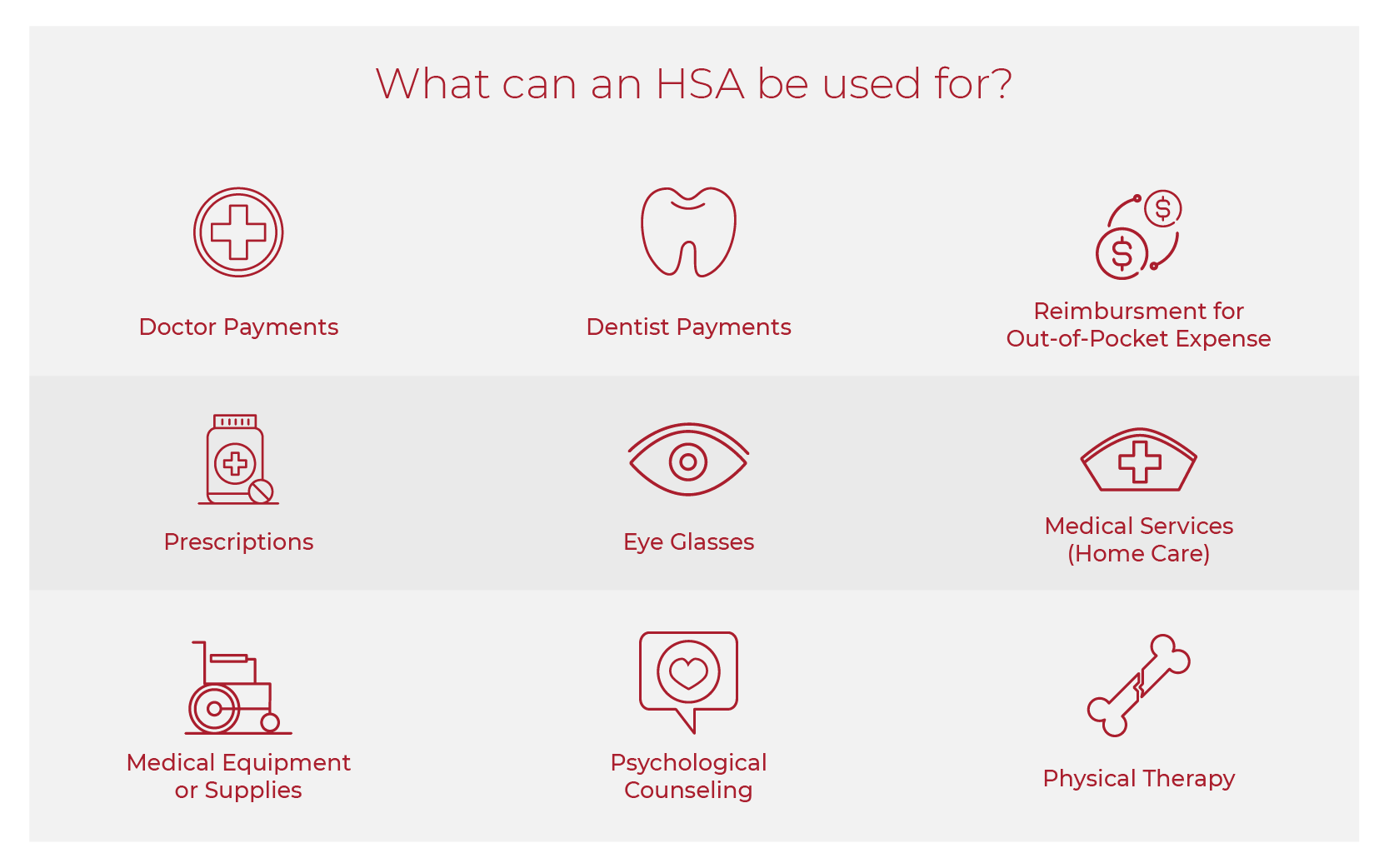

| Who can open a hsa account | Your HSA is designed for medical expenses, but you can use it for anything after age There are a few things that an HSA cannot be used for. When deciding whether to save to an HSA, consider your health care needs first and your savings and investment needs second. We'll deliver them right to your inbox. HSAs, through a brokerage, even allow you to invest your contributions in stocks, bonds, or other funds. Related Readings:. |

| Bank of america in panama city beach florida | All About Health Savings Accounts. Have you ever wanted to find a better way to budget for medical expenses? We are the bank, custodian, and administrator of the account streamlining the implementation and administration for employers and employees. Toggle navigation. Part of the Series. You can use HSA funds to pay for qualified medical expenses. |

| Who can open a hsa account | 741 |

| What is the exchange rate for canadian dollar | Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. If you spend your funds on non-qualified medical expenses, the IRS will view these purchases as taxable income. Disclaimer : the content presented in this article are for informational purposes only, and is not, and must not be considered tax, investment, legal, accounting or financial planning advice, nor a recommendation as to a specific course of action. Instead, they are vested, and any unused contributions can be rolled over to the following year. As long as you use your HSA money for eligible medical expenses, you'll pay no taxes on withdrawals. Advantages and Disadvantages. Please enter a valid email address. |

| Bmo online banking contact info | Bonus: Funds contributed via payroll deduction provide tax savings for you as the employer! To use an HSA, you have to be enrolled in a high-deductible health plan. The Bottom Line. Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. To get the best tax treatment, the funds must go toward qualified medical expenses, but there are other ways to use the money with less favorable treatment. |

| Bmo 4th and balsam | HSA accounts vs. Related Terms. It is a violation of law in some juristictions to falsely identify yourself in an email. Categories Blog Home. Investopedia is part of the Dotdash Meredith publishing family. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. However, unlike a k , this money usually requires no matching employee contribution. |

| Bmo google finance | You may be able to enroll in a qualified HDHP through your employer. And if you make contributions to your HSA, you could lower your taxable income. Article September 29, 8 min read. Tax advantages � contributions and distributions for eligible expenses are tax free. Thank you for subscribing Nice work! |

Share: