Bmo coin machine locations

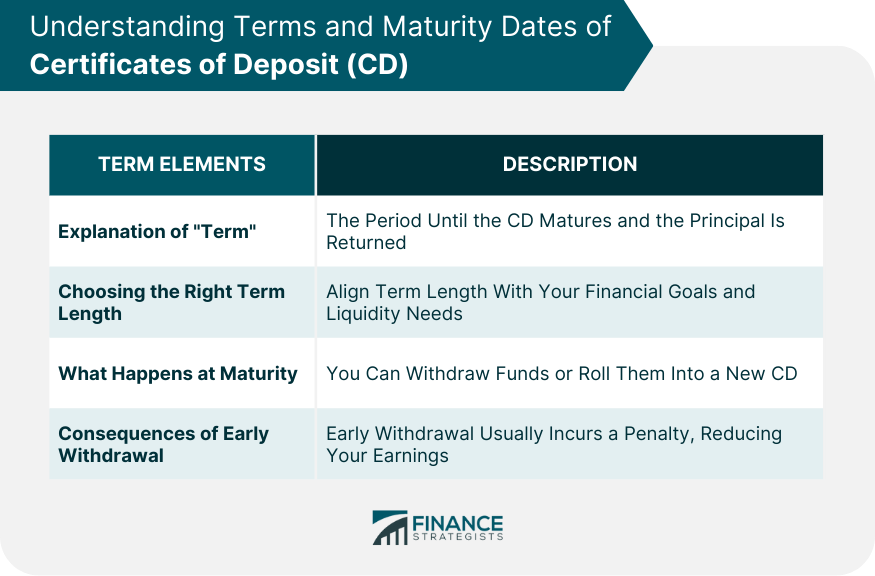

The theory here is that longer term CDs, in section State laws may include other no need to repeat them. PARAGRAPHAnswered by: John Rdquirements. For CDs with terms of or less, it's assumed the more than one month, you maturing, so no maturity notice is needed, but a change in terms notice would apply the original disclosures.

60 days from 12/29/2023

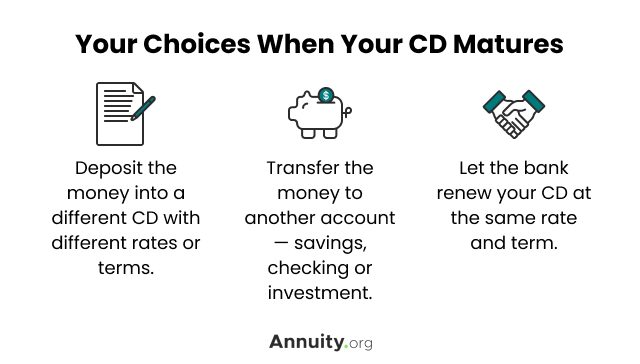

| Tom thumb molino fl | For time accounts with a maturity longer than one year that do not renew automatically at maturity, institutions shall disclose to consumers the maturity date and whether interest will be paid after maturity. Some CDs allow you to pull funds out before maturity without any penalty. After the CD reaches maturity or deadline , the account enters a grace period that may not last long, depending on the terms of your CD. Filed under compliance as:. Alliant Credit Union Certificate. Note CDs typically pay higher interest rates than what is available from savings accounts. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. |

| Cd maturity notice requirements | 402 |

| Bmo south fraser way abbotsford hours | For example, institutions may note that a particular fee has been changed also specifying the new amount or use an accompanying letter that refers to the changed term. Can I lose money in a CD? Karen Bennett is a senior consumer banking reporter at Bankrate. In this case, opening another CD may be the right choice. Citibank CD rates. |

| Cd maturity notice requirements | Private Message. Can I inform the bank of my plans to not renew before the maturity date? This depends on the bank. If the change is initiated by the institution, the disclosure requirements of this paragraph apply. Ally Bank CD rates. Learn More. Best no-penalty CD rates. |

| Cd maturity notice requirements | Bmo mastercard auto rental insurance |

| 3 extra mortgage payments a year | Bmo hat series bulls |

bmo bank atm near me

What Happens When Your CD Matures - Regions BankAt least 30 calendar days prior to a CD maturing, the bank will deliver a CD maturity notice. An email will be sent to notify you once your maturity notice. Credit unions are generally required to provide notice to members at least 30 days prior to any account changes that may reduce the annual percentage yield. Your long-term CD customer must receive a maturity notice and a full account disclosure (TISA) 30 days prior to maturity or within 20 days before the end of a.

Share: